The best fund admins for emerging VCs (2025)

How they differ, what they cost, and which one is the best fit for you.

A fund admin is an emerging VC’s most important service provider. Here’s my take on the best options for venture funds in the $10M-$100M range, based on my experience as fund counsel for dozens of emerging VCs and conversations with many more.

But before I jump in, please subscribe for more highly practical content about launching and running an emerging venture fund:

Here’s what’s in this post:

The master comparison chart

What does a fund admin do?

There are three core services that every fund admin will provide:

Internal Accounting: The most basic function of a fund admin is to prepare the fund’s books and records, track the fund’s transactions, and make sure that each limited partner (LP)’s interest is properly recorded, and the fund’s income and expenses are correctly allocated to each LP. This internal accounting is like ordinary book-keeping, but it needs to strictly follow the rules laid out in your fund documents to avoid serious consequences from LPs and the SEC.

Capital Calls & Distributions: Every fund admin will oversee your fund’s capital calls and distributions. That means calculating each LP’s portion of the capital call or distribution, sending the appropriate notices to those LPs, making sure that the money has actually changed hands, and reflecting the transaction in the fund’s books and records.

LP Reporting & Communications: Every fund admin will provide some sort of reporting to your LPs regarding the fund’s finances and the value of the fund’s portfolio. This is often done through a combination of an annual financial statement and an online LP dashboard which provides real-time views of the value of each LPs’ interest in the fund, their remaining capital commitment, and other key information. In addition to this reporting, fund admins distribute notices, amendments and other formal communications to the fund’s LP-base.

Many fund admins go beyond that core set of services, and try to act more like a comprehensive back-office for their clients with the following:

Closings: Some fund admins will provide an online platform that allows you to admit LPs into the fund (i.e. “close” the LPs) by uploading fund documents, gathering key information and signatures from LPs, and gathering counter-signatures from the general partner (GP) of the fund (which is probably you). These fund admins will often also handle key LP diligence - known as AML/KYC (anti-money laundering/know your customer). This is a very valuable service because funds often have dozens to hundreds of LPs, and shuffling this paper and performing the diligence can be very labor intensive. Fund admins who do not handle closings often refer out to Passthrough - a streamlined and simple closing platform that often charges ~$10,000 per fund.

Taxes: While every fund admin will handle your fund’s internal accounting, only some will prepare the fund’s tax return and K-1s. Fund admins who do not handle tax accounting often have close relationships with accounting firms that frequently work with emerging VCs, such as Andersen (which handles taxes but not audit), Frank Rimerman, Sensiba and Weaver. Hiring a third-party accounting firm to prepare the fund’s taxes generally costs $8,000-$12,000 per year.

Valuations: Every fund is required to value its investments at least annually using a reasonable and consistent valuation policy. While this is generally simple in the early years of the fund (using a “latest round value” method), it can get more complex in the later years of a fund. Some fund admins will perform these valuations for their clients using industry-standard “ASC 820” valuation methods.

AML Compliance: While VCs were previously exempted from “anti-money laundering” (AML) compliance, that’s about to change. Starting in 2026, emerging VCs will be required to assess the AML risk of their LP-base, adopt policies and procedures to manage that risk, and run regular AML checks on each LP, among other requirements. Some - but not all - fund admins perform AML checks as part of their services, which better positions them to help with these new compliance requirements.

In addition to varying on features and price, fund admins also vary on some softer factors, like whether they primarily focus on emerging VCs (which can make them easier to work with, especially for newer managers) or limit price increases during a fund’s term. One soft factor that does not to vary across options: while all of the admins have developed extensive “platform” apps to help manage your fund, most interactions with your fund admin will likely still occur through a human interface (email, phone etc.).

What are some popular options for emerging VCs?

There are dozens of fund admins out there, but a few names regularly pop up when it comes to emerging VC funds.

Vector AIS: Vector is a newer fund admin that is focused on the emerging manager community, with a very experienced team and a good balance of human support and technology. They are a “service-first, people-first firm elevated by technology”, with a proprietary platform called Valence. Because the firm is new and growing, it often offers an attractive mix of competitive pricing and top-notch service.

Aduro: Aduro is one of the best known and most established fund admins for emerging VCs. Since 2012, they have worked with, and grown alongside, standout funds like FirstRound and Craft. It’s a trusted and dependable option, that combines a very experienced team with a proprietary platform called FundPanel. Aduro offers a good combination of well-known brand, “high-touch” support, and well-designed tech.

Carta: Carta is a ubiquitous presence and platform in the venture ecosystem. It has a strong fund admin division that aims to act as a comprehensive back-office, and works with a broad range of fund sizes (from $5M-$1B+ AUM). Carta tends to be competitively priced and fully featured, and frequently ships new features. Their product includes valuable add-ons and perks (including Tactyc, their newly acquired portfolio modeling tool), and is backed up by a large, multi-national team of 450+ employees.

AngelList (jointly with Belltower): AngelList’s fund admin service is built to be a comprehensive back-office for emerging VCs. While AngelList is explicitly product-focused and thinks of itself as a software company, the human support at AngelList is actually a great fit for new emerging VCs who need a bit more orientation and help.

NAV: NAV has been in the fund admin business for 30 years and is a very professional and competitively priced option for emerging VCs. You can expect high quality and efficient service, and a relatively full set of features and services (like taxes, closings, and AML/KYC). NAV is also a well-known option for crypto funds, and should be on the list of any emerging VC who is focused on digital assets (especially when a fund will be actively trading crypto in addition to its standard venture investments).

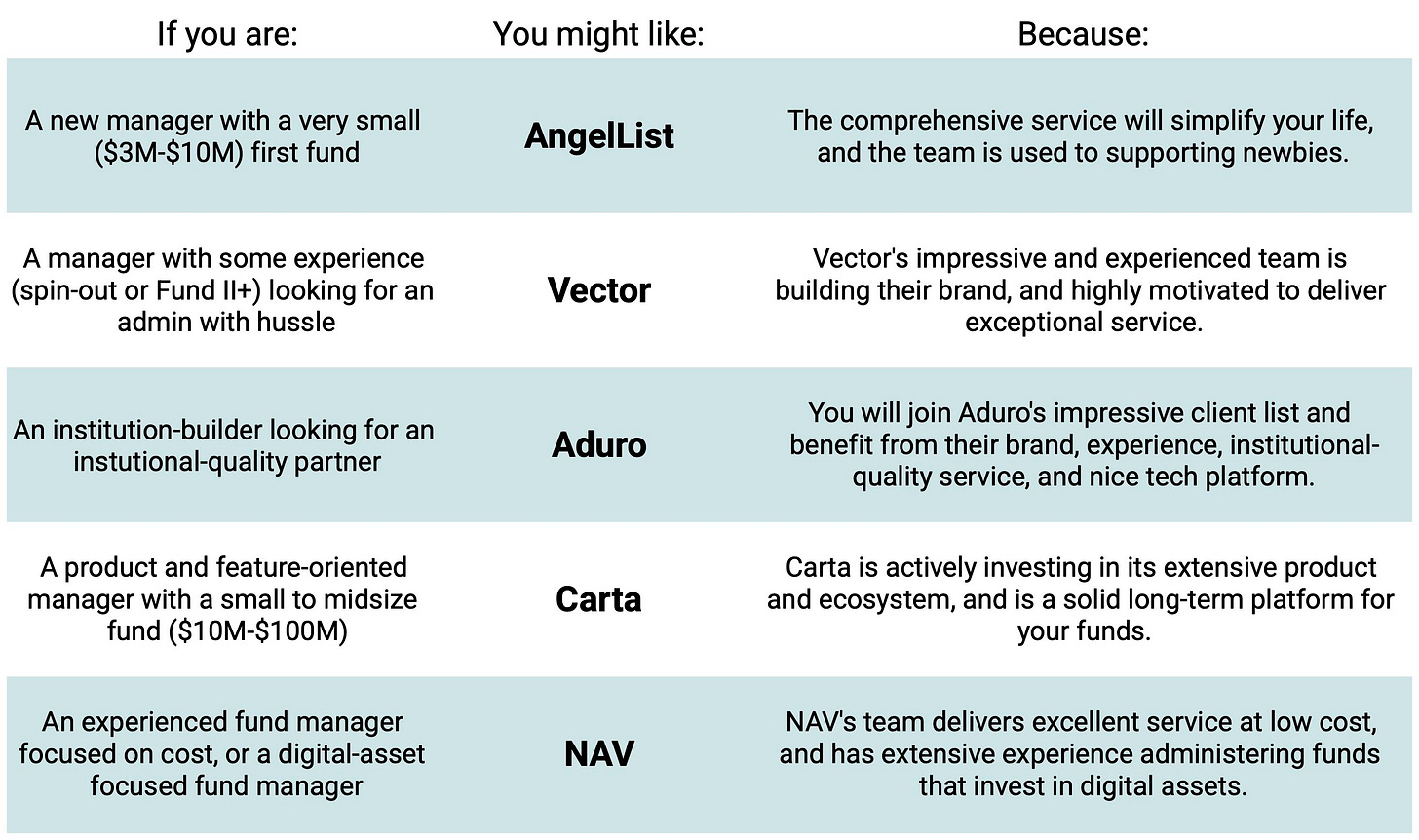

Which fund admin is best for you?

I’ve sketched out a few very subjective recommendations below. Every emerging VC is unique and should consider and interview multiple fund admin options to see which one seems like the best fit.

Other options to consider

This post has focused on a few of the most popular fund admins for emerging VCs raising funds in the $10M-$100M range. Here are a few other options that might be worth considering:

Sydecar: Sydecar is a venture-backed, product-focused fund admin that offers turn-key venture fund formation and administration. They’re usually the fastest and least expensive option for VCs looking to form and run very small funds (<$5M in capital commitments).

Juniper Square: Juniper Square is a well-known fund admin with $100B+ under administration and over 100 VC clients. While most of its business is in other asset classes, Juniper Square is an increasingly popular option for larger emerging VCs. Its clients get a combination of “white glove” human support and well-designed tech. That "white glove" service leads to higher pricing, so Juniper Square usually isn't a competitive option for funds under $25M.

Standish: Standish is a large, institutional fund admin with $500B+ under administration. It recently acquired Cornerstone, which was an emerging VC-focused fund admin known for “white glove” human support for both GPs and LPs, with pricing similar to Aduro’s pricing. While Cornerstone has been assimilated into the larger Standish organization, its team is still intact and focused on emerging VCs. The Cornerstone team have been a great fit for funds with LPs who wanted exceptional support from the fund admin team.

That’s it for this post! You can find out more about my fund formation services on the Lidow PC site. To connect with me about this post or other fund-related questions, you can message me on LinkedIn or schedule a call here.

And if you haven’t already, please subscribe for more highly practical posts about forming and managing a venture fund: