The Limited Partnership Agreement (“LPA”) is the core document that governs a venture fund; it’s where your management fee, carried interest and other terms of your fund are set in stone. This post focuses on 9 key LPA terms that every emerging manager should understand, tells you why they’re important, and gives you a sense of what’s market for emerging managers raising Fund I.

A few notes before I jump in:

There isn’t much hard data available on market terms for Fund I. My “Fund I Market” suggestions are based on my conversations with dozens of emerging VCs and many of their LPs, surveys of Fund I LPAs drafted by several different law firms, and personal experience forming many Fund Is.

You may see data about market terms for small funds (<$25MM or <$100MM AUM) that doesn’t match perfectly with what I’ve written here - that’s because those datasets often include mature firms with later vintage funds, and aren’t representative of what I see in Fund I LPAs.

If you haven’t already, please subscribe!

Table of Contents - 9 key LPA terms for emerging VCs

1. Management Fee

What It Is: The management fee is a fee that is paid regularly throughout the term of the fund to compensate the manager for running the fund, regardless of the performance of the fund. This fee is usually quoted as a percentage of capital commitments per year.

Why It Matters: Management fees are often the sole source of revenue for a venture firm. While mature firms tend to be generating management fees from multiple, higher-AUM, funds, new managers have to cover their operating costs from the management fees generated by one or two small funds.

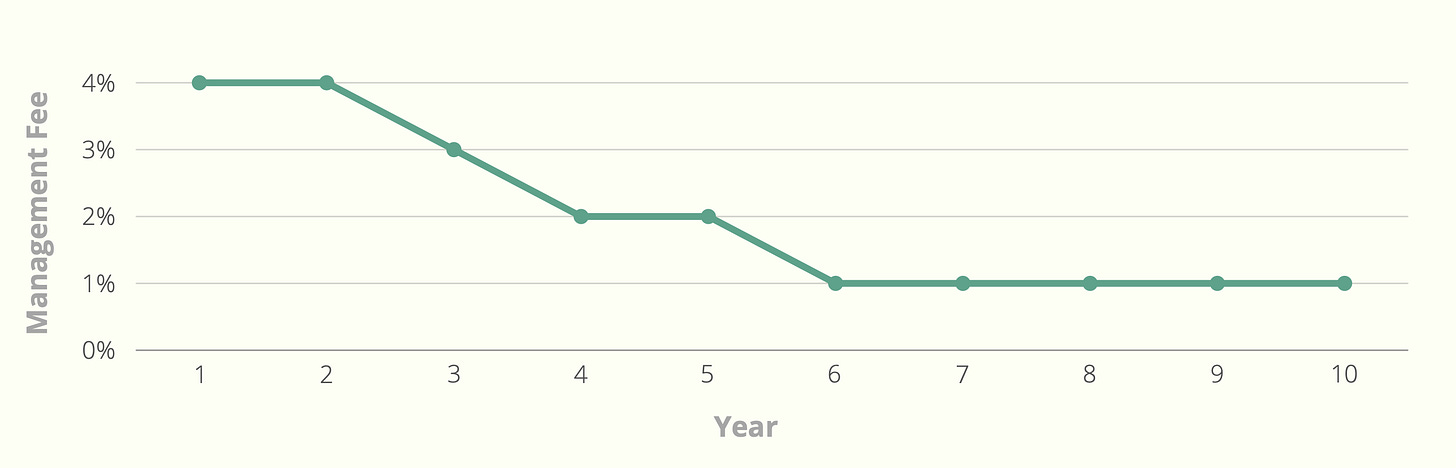

Fund I Market: 2%-2.5% average annual rate, often “front-loaded”.

To make the cash-flow work, many emerging VCs charge a management fee above the traditional 2% market rate and/or front-load by charging higher management fees (up to 4%) in the initial years of the fund, offset with lower fees (usually 1%) at the end of the term. In order to be justifiable to LPs, these fees (which would be above market in a more mature fund) should be driven by the reasonable cash-flow needs of the manager.⚠️ Note of Caution #1: Some LPs who are not familiar with emerging VCs react negatively to anything other than a flat 2% management fee. Management fees that are >2% and/or are front-loaded are (when justified by cash-flow needs) generally accepted by LPs who are familiar with emerging VCs, and are tolerated by other LPs when they’re writing small checks.

⚠️ Note of Caution #2: The SEC has sued managers that misled LPs about the fund’s fee schedule. Any front-loading of management fees must be clearly disclosed to LPs before they subscribe to the fund.

2. Carried Interest Percentage

What It Is: The carried interest percentage is the percentage of the fund’s profits that gets distributed to the General Partner of the fund. For example, if a fund makes $10M in capital calls, and distributes $30M, then the GPs will receive $20M multiplied by the carried interest percentage. The calculation of carry can change based on the fund’s waterfall (see “Distribution Waterfall” below).

Why It Matters: Carried interest makes sure that the GP does well when the LPs do well - it aligns their interest in the upside of the fund. Carry is also generally the GP’s primary financial incentive for forming the fund. While carry does not get paid out until the fund has distributed a substantial amount of money (often in the later years of the fund), the amount of carry generated by a fund can be much greater than the management fee. For a fund returning 5x its capital contributions (which is often the target for pre-seed funds), the carry should total ~4x the management fees. This exposure of the GP to the fund’s upside aligns the GP’s and LP’s interest

Fund I Market: 20% carried interest.

⚠️ Note of Caution: Some emerging VCs will ask for “premium carry” - usually 25% or 30% carried interest on any distributions beyond a certain profit threshold for the fund (e.g. after 3x return). While premium carry shows up in some Fund Is raised during frothy fundraising periods, it’s not market and many LPs react negatively to the ask. Most emerging VCs should avoid asking for premium carry and, if they receive it, should expect that it will be taken away in future vintages as the firm scales and takes on institutional LPs.

3. Distribution Waterfall

What It Is: The distribution waterfall governs how money comes out of the fund, including when carried interest kicks in. There are two main types of waterfalls - “deal-by-deal” and “whole-fund”. Deal-by-deal (or “American”) waterfalls distribute carried interest to the GP from any profits generated by an individual deal, and then claw-back overpayments (which often occur) at the end of the fund’s term. Whole-fund (or “European”) waterfalls only distribute carried interest when the whole fund is profitable - i.e., when the fund has distributed more than the total capital contributed to the fund. In addition to these two core types of waterfalls, some waterfalls include additional components like: (1) an LP-friendly “hurdle” interest rate that accrues and must be distributed before carried interest kicks in, or (2) a GP-friendly “catch-up” that ensures that the GP receives their carried interest percentage of all distributions, not just the profits from the fund.

Why It Matters: The primary purpose of any fund is to eventually distribute returns to its partners. The waterfall determines who gets paid, when they get paid, and how much. The waterfall’s construction can significantly shift the fund’s finite returns from the LPs to the GP or vice versa.

Fund I Market: Whole-fund waterfall, without hurdle or catch-up.

4. GP Commit

What It Is: GPs are often required to invest in the fund alongside their LPs. The GP Commit is the percentage of the fund (or sometimes a set amount of money) that the GP commits to invest. In larger funds, the traditional market GP commit is around 1%-2% of the size of the fund - so in a $100M AUM fund, the GP would be required to invest $1M+.

Why It Matters: LPs want to know that the GP is going to have some downside exposure to the fund - that the GP will lose something if the fund performs poorly. Together with carried interest, the GP Commit aligns the financial interests of the LPs and the GP.

Fund I Market: A personally significant amount - highly variable by GP.

Many emerging VCs do not have significant liquid wealth. LPs who are familiar with the emerging venture asset class understand this, and simply require that the GP invest an amount of money that would be meaningful to lose for the GP. Many emerging VCs also satisfy this obligation by waiving management fees (see Cashless Contributions below), especially if it’s difficult to personally invest 1%+ in cash.

5. Cashless Contributions

What It Is: Cashless contributions are an alternative way of paying for the GP’s stake in the fund (see GP Commit above). Instead of paying entirely in cash (or warehoused securities), the GP pays for some of their stake by irrevocably waiving a portion of their management fees. For example, if the GP has committed to investing 2% of a $10M fund, the GP can pay for this stake with $100K in cash and $100K in waived management fees.

Why It Matters: Many emerging VCs have limited personal liquidity when they launch Fund I. Cashless contributions allow those GPs to make a larger GP Commit than they otherwise would be able to.

Fund I Market: Up to 80% of GP stake paid for through cashless contributions.

⚠️ Note of Caution #1: This structure has significant tax benefits for GPs, essentially turning ordinary income into capital gains; however, it needs to be structured correctly to avoid IRS scrutiny.

⚠️ Note of Caution #2: Make sure to reflect any cashless contributions in your cash-flow model for your management company.

⚠️ Note of Caution #3: Cashless contributions should be clearly disclosed to LPs before they subscribe to the fund.

6. Capital Recycling

What It Is: Capital recycling is the ability to re-invest some proceeds from your fund’s exits, instead of distributing those proceeds to your LPs. Capital recycling is generally subject to a time limit (e.g. you can only recycle during your investment period) and an amount limit (e.g. you can only invest up to 125% of the committed capital).

Why It Matters: Without capital recycling, you can only invest ~75% of your committed capital (the rest goes to management fees and other fund expenses). Re-investing some of the proceeds from early exits allows you to invest 100%+ of your fund’s committed capital. It also allows you to “replace” portfolio companies that exit early through small acquisitions, which can be important for maintaining your intended portfolio construction.

Fund I Market: Recycling permitted up to 125% of capital committed, and within the first ~5 years of the fund.

⚠️ Note of Caution: Recycling capital can sometimes work against the primary goal of many emerging VCs - quickly establishing a track record and getting to the next fund. By recycling proceeds from a successful exit, the manager delays distributions and puts the distributable cash at risk. This can reduce DPI or, even if it increases DPI, reduce IRR. It can often be a better choice to make investments out of a new fund than to recycle capital.

7. Key Person Events / GP Time Requirement

What It Is: LPAs often include (1) a requirement that the partners devote a certain amount of their business time to the fund and (2) a “Key Person” clause that suspends capital calls and new investments (called a “suspension period”) if the key people leave. This can be structured in many different ways - including whether the suspension period is triggered automatically when the key person leaves, or whether it requires the LPs to trigger it.

Why It Matters: Emerging venture firms are generally run by one or two partners, and a fund can fail if those partners lose interest or leave. The Key Person provisions give LPs some control over the fund if that happens.

Fund I Market - Time Requirement: Phrased flexibly (e.g. “such time as is reasonably required to manage the fund”), especially after the investment period has ended.

Fund I Market - Key Person Event: In a solo-GP fund, the suspension period is triggered automatically if the solo-GP is no longer involved in managing the fund. In a multi-GP fund, the suspension period is triggered automatically if all partners have left the fund.

⚠️ Note of Caution: Avoid making a full-time commitment to the fund that applies after the investment period, even with a carve-out that allows you to raise/manage successor funds. Not all managers can (or want to) raise a Fund II, and a full-time commitment will interfere with the ability to perform work outside the venture firm.

8. Fund Expenses

What It Is: Running a fund costs money - you need to pay yourself, lawyers, accountants and admins. You have filing fees, franchise taxes, office space, SaaS subscriptions etc. Your LPA will define which costs are paid by you, the manager, out of your management fees, and which are fund expenses, paid by the fund. Fund administration and legal fees are always covered in fund expenses, and salaries and office space are always management company expenses. But there other expenses - like investment due-diligence costs, the legal set up costs of the GP and management company, and the regulatory compliance costs of the management company - that can fall into either category.

Why It Matters: For emerging VCs raising Fund I, the management fee income is relatively small because your fund size is low (management fee is a % of the fund size) and you only have one fund under management (vs. multiple funds all producing fees). GPs generally want to minimize the expenses that get taken out of the management fee, and push as many expenses onto the fund as possible. A GP-friendly definition of Fund Expenses will save a cash-strapped emerging VC tens (sometimes hundreds) of thousands of dollars over the life of the fund.

Fund I Market: Broad definition of Fund Expenses, which includes the legal formation and maintenance costs of the GP and management company, and any expenses related to a portfolio company investment (including travel and due-diligence costs).

9. Reporting

What It Is: The LPA requires the GP to periodically report to the LPs on the fund’s financial state and (sometimes) its investments and sales of assets. Reporting is usually quarterly or annually, and at minimum includes un-audited financial reports.

Why It Matters: A venture fund is a “blind pool” of capital, and the LPs have no control over the investment of, and limited insight into what you’re doing with, their money. Reporting provides some degree of transparency to the LPs, which helps them feel comfortable handing their money over to you. This is especially important with first time managers who don’t have a track-record as a financial fiduciary. However, reporting can get costly and time consuming - especially when audits are required for financial statements.

Fund I Market: Annual un-audited financial statements, and reporting of investments/sales at the discretion of the GP.

⚠️ Note of Caution #1: While the reporting requirements in the LPA may be GP-friendly, that doesn’t mean that you shouldn’t communicate often with your LPs. Quarterly emails or calls are generally best practice for keeping your LP base happy.